Debt and inheritance

Believe it or, but there are people out there who haven't been following this whole government debt debate from the very beginning. (That is, whether locally financed debt can ever really be a burden to future generations since we effectively owe it to ourselves. ) After a recent link from Daniel Kuehn, I finally decided to bite the bullet and have a quick look over some posts. I may be covering very stale ground here, but please bear with me while I wade in at this very late stage.

Right, so following from Daniel's links, I've clicked through to Bob Murphy's blog. Bob is shameless about his addiction to this debt issue and apparently has infinity + 1 posts on it. I've read these two. (And didn't even make it to the comments!)

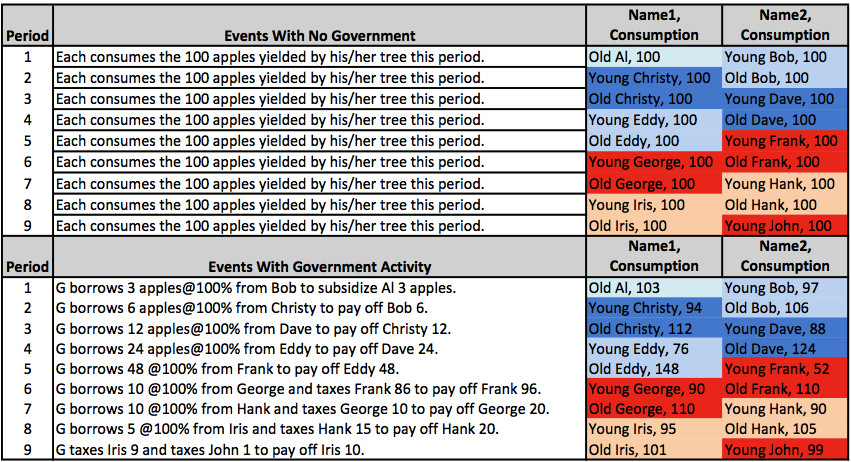

All the action effectively happens in period 6 when the government switches financing schemes. (In addition to young people financing old people, those same old people are now also being used to "pay back" their younger selves.)

However, it seems to me that Bob's model is missing the fundamental part of Baker et al.'s argument. Clearly, "old" Frank is not being compensated for the money that he is being taxed to pay back to his "younger self". In other words, it is the switching of financing schemes that matters. As I understand the Baker et al. argument, Frank should have 86 apples' worth of bonds in period 6 that must be left to someone when he dies. No-one inherits "Old" Franks' bonds and, consequently, they can never be redeemed.

Here is Baker making this exact point:

As a country we cannot impose huge debt burdens on our children. It is impossible, at least if we are referring to government debt. The reason is simple: at one point we will all be dead. That means that the ownership of our debt will be passed on to our children.

Comments