Inflation-targeting, CPI measures and the poor

There are a number of legitimate reasons to critique an inflation-targeting regime. Further, the relatively high inflation burden felt by poorer segments of society certainly merits attention in of itself. That said, there are some persistent misconceptions among the public about inflation-targeting: What are its goals and what are the (theoretical) mechanisms by which these are achieved — particularly w.r.t. a central bank's chosen CPI measure? My gripe with this article is that it may perpetuate such misconceptions by failing to acknowledge an important principle of inflation-targeting.

Rather than simply being an end in of itself, an inflation target is also seen as a means of stabilising the output gap (and ultimately smoothing of the business cycle). Theoretical justification for this so-call "divine coincidence" — which implies no trade-off between the twin goals of stabilising inflation and maintaining optimal economic output — is derived from the standard new Keynesian DSGE models favoured by a large segment of macroeconomists. See Blanchard and Gali (2005), or as Blanchard has written elsewhere:

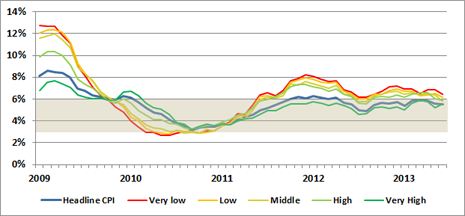

This is a really important result. It implies that central banks should indeed focus just on inflation, and can sleep well at night. If they succeed in stabilizing inflation, they will automatically generate the optimal level of activity. (p. 3)The upshot is that, if we are going to criticize the representativeness of headline CPI for all income groups, then we should at least acknowledge it's (intended) wider role in stabilising the output gap. (The CPI basket is chosen, after all, because it corresponds to average purchases within the economy as a whole.) You can certainly argue about the conditions under which "the divine coincidence" is satisfied, as well the theoretical underpinnings of the DSGE models. However, closing the output gap is probably very much in the poor's interest as well.

On a final and related note, there are severe drawbacks to the SARB targeting a predominantly commodities-based basket that would more closely accord with the average purchases of low-income families. Most obviously, the SARB is more or less powerless to control the inherent volatility of commodity groups, not to mention the potential for causing very counterproductive amplifications in the consumption cycle. (See here, esp. end of point 4.)

Comments