Carbon Price vs Technology (R&D) Initiatives

Both are necessary but neither is sufficient:

For many years, there has been a great deal of discussion about carbon-pricing – whether carbon taxes or cap-and-trade – as an essential part of a meaningful national climate policy. It has long been recognized that although carbon-pricing will be necessary, it will not be sufficient. Economists and other policy analysts have noted that policies intended to foster climate-friendly technology research and development (R&D) will also be necessary, but likewise will not be sufficient on their own.

For the former, his basic argument is that a carbon price (i.e. carbon tax or cap-and-trade) internalises the negative externalities of CO2 at the least cost to society; something widely agreed on by economists. It does this by establishing a level playing field that allows for decentralised decision-making by firms on how best to reduce their own emissions, while also overcoming problems of pollution heterogeneity. (In economics jargon, a carbon tax or cap-and-trade can ensure that marginal costs of abatement are equalised across producers... Which basically just means that we cut our pollution as efficiently as possible.)

In other words, we probably need active technology polices that aim to foster innovation and R&D directly. Stavins doesn't readily name many examples in his post, but they include things like targeted investment support and government research, as well as feed-in schemes for alternative energy sources. These issues all fall within the category of innovation economics, which is a very interesting field. (Unfortunately, the wiki entry on innovation economics that I've linked to here is pretty poor in my opinion. Nothing on lock-in and path dependency, learning effects and learning-by-doing, spillovers and network effects,...)

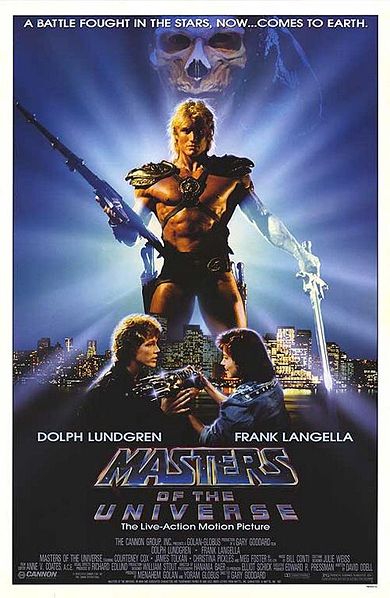

|

| Gun? Check! Sword? Check! |

Comments